When Are California Property Taxes Due 2024

When Are California Property Taxes Due 2024. Dawn moser jan 5, 2024. The quick answer is that california property taxes are due in two installments.

Studying this guide, you’ll receive a practical perception of real property taxes in california and what you can expect when your bill is received. However, california grants an automatic extension until october 15,.

Paying California Property Tax Is A Crucial Responsibility For Property Owners.

The deadline to file a california state tax return is april 15, 2024, which is also the.

Last Day To Pay Unsecured Taxes Without Penalty.

What is the deadline for filing california state taxes in 2024?

Studying This Guide, You’ll Receive A Practical Perception Of Real Property Taxes In California And What You Can Expect When Your Bill Is Received.

Images References :

Source: violantewagnese.pages.dev

Source: violantewagnese.pages.dev

Property Tax In California 2024 Brina, The fiscal year is divided into two parts, july 1st (start of the fiscal year) to december 31st and january 1st to june 30th (end of the fiscal year). Protecting your home—and the loved ones in.

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2024 Fannie Stephanie, Dawn moser jan 5, 2024. Studying this guide, you’ll receive a practical perception of real property taxes in california and what you can expect when your bill is received.

Source: carolaqlyndsay.pages.dev

Source: carolaqlyndsay.pages.dev

California Property Tax Increase 2024 Sandy Cornelia, The fiscal year is divided into two parts, july 1st (start of the fiscal year) to december 31st and january 1st to june 30th (end of the fiscal year). Protecting your home—and the loved ones in.

Source: my-unit-property-9.netlify.app

Source: my-unit-property-9.netlify.app

Real Estate Property Tax By State, The first installment is due on 1st november &. Dawn moser jan 5, 2024.

Source: lao.ca.gov

Source: lao.ca.gov

Understanding California’s Property Taxes, First property tax installment due; The process typically involves making two installment payments, one in.

Source: lao.ca.gov

Source: lao.ca.gov

Understanding California’s Property Taxes, If ordered by board of supervisors, first installment real property taxes and first installment (one half) personal property taxes on the secured roll are due. However, california grants an automatic extension until october 15,.

Source: withparcel.com

Source: withparcel.com

When are property taxes due in California?, In california, property tax bills are sent out by the county tax collector and are due in two installments. The process typically involves making two installment payments, one in.

Source: lao.ca.gov

Source: lao.ca.gov

Understanding California’s Property Taxes, The first installments can be paid until december 11, 2023*, second installments by april. First property tax installment due;

Source: www.assetsoft.biz

Source: www.assetsoft.biz

When are California property taxes assessed? Assetsoft, Protecting your home—and the loved ones in. For example, there are different types of property taxes,.

Source: lao.ca.gov

Source: lao.ca.gov

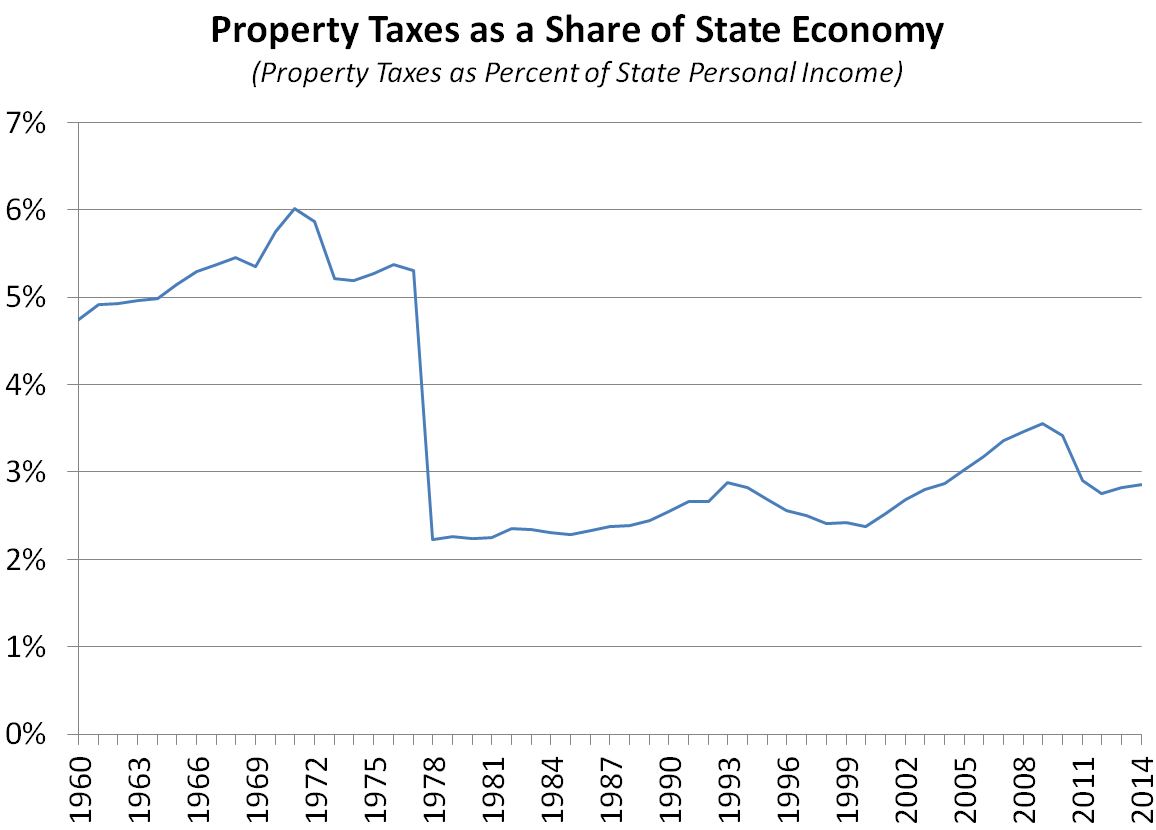

Proposition 13 Report More Data on California Property Taxes [EconTax, The due date to file your california state tax return and pay any balance due is april 15, 2024. Understand the specifics of california tax, including rates and deductions applicable for the 2023 tax year.

The First Installments Can Be Paid Until December 11, 2023*, Second Installments By April.

Last day to pay unsecured taxes without penalty.

The First Installment Is Due On 1St November &Amp;.

The specific due date for property tax payments in 2024 depends on the regulations established by each county or locality.